How Galleries Can Make the Most of Art Basel and UBS’s “The Art Market”

ARTSY FOR GALLERIES

Covering the biggest trends from the state of the economy to art fairs and auctions, Art Basel and UBS published their 2018 global art market analysis, The Art Market this past March. Artsy Editorial summarized the key takeaways from the report, including that “the market is back up after years of decline.”

Read on for actionable insights for galleries to help dealers of all kinds meet the challenges of the coming year.

1. Think Globally

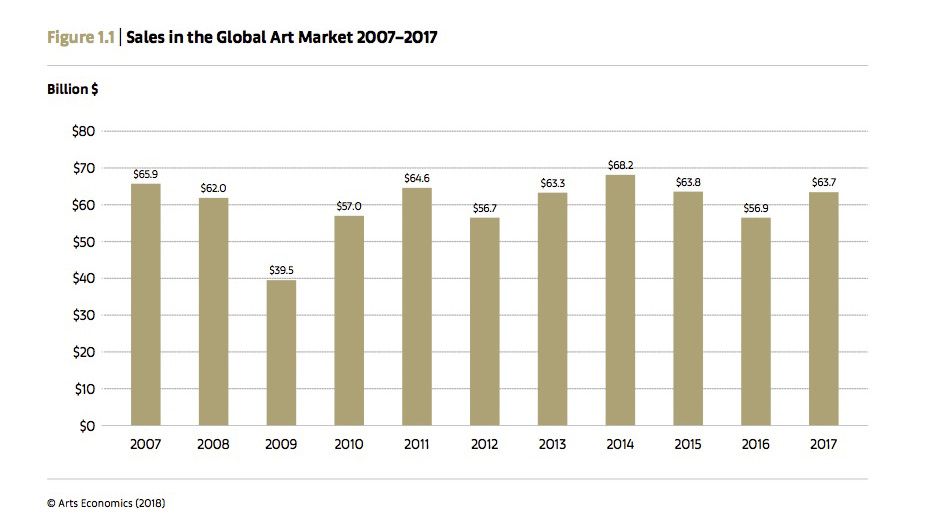

In 2017, sales in the global art market, led by the U.S., U.K., and China, reached $63.7 billion. According to Art Basel and UBS, this boom in sales can be partially attributed to a strong economy around the world.

This past year, 35% of High Net Worth Individuals participated in the art market while aggregate global wealth reached $280 trillion (up 6.4%) and the number of millionaires grew 7% to reach 36.1 million. To take advantage of this trend, the report recommends dealers keep an eye on the growing Asia-Pacific region and expanding emerging economies, including India.

For gallerists looking to take advantage of new wealth, online art platforms like Artsy offer access to global networks of collectors, reducing the need for costly travel. Additionally, regional social media platforms can expand global reach—for example, WeChat can increase access to collectors in China who have been historically more difficult to reach online.

2. Bridge the Middle Market Gap Digitally

Despite boasting high sales, the market showed cause for concern for a majority of dealers—less than 5% of the estimated 296,540 businesses were responsible for total dealer sales by value. Even more worrisome, “more than 20 notable galleries in mature markets closed in 2017.”

This imbalance, the report observes, is evidence of an expanding gap between “mega-galleries and mid-size to lower end galleries,” where primary market dealers who nurture emerging artists lose them to mega-galleries as soon as they become successful. If this dynamic continues, Art Basel and UBS predict that the market could become dangerously top-heavy with the middle market vanishing completely.

Investing in digital tools to drive sales can help sustain mid-size galleries and close the gap. For example, Artsy has also seen growth in for sale inventory roughly double over the past year across all gallery types.

3. Make the Most of Fairs

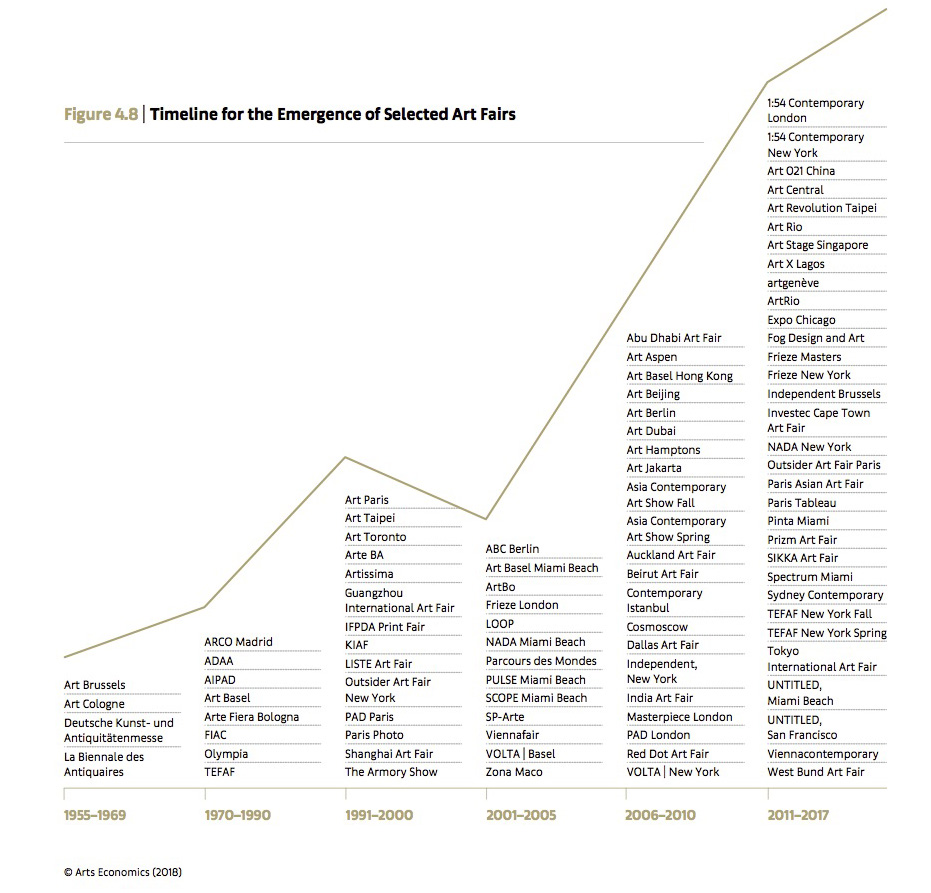

Like the overall market, art fairs this year boasted an exceptionally strong performance, drawing in $15.5 billion in sales, a 17% increase from 2016. Notably, dealers made 46% of their sales at fairs (up 5% from the previous year). In 2017 alone, there were more than 260 major art fairs that drew more than 1 million visitors from around the world—50 of which opened in the past 10 years.

On Artsy, more than 88% of gallery partners make the most of their fair investments by uploading booths up to two weeks before the fairs begin. The Art Market report even noted how galleries are optimizing their fair offerings for digital channels, with 42% of galleries participating in Artsy pre-fair previews listing their prices online.

4. Find Creative Business Models

2017 marked the first year that more galleries closed than opened. Just ten years ago, there were 87% more gallery openings than there

Some galleries started sharing spaces, while others have abandoned their physical spaces to go online. For example, in a recent webinar, Artsy brought together gallerists from Los Angeles, London, and New York to talk about nontraditional gallery models including advice on running online-only and pop-up galleries in today’s market.

5. Invest in Your Online Presence

The online art and

Providing a relatively low-cost alternative to art fairs, online platforms can provide similar benefits to dealers who are looking for access to collectors and a centralized marketplace, especially when it comes to expanding their networks. Reported by Art Basel and UBS as the most commonly cited third-party platform, Artsy has more than 2 million unique visitors per month across web and mobile, with monthly traffic

__________________________________

To find out how Artsy can help your gallery grow and thrive in the coming year, visit our Gallery Partnerships page.

Placeholder text for the page body.

Placeholder caption.

Placeholder text for the page body.

Placeholder caption.

Placeholder text for the page body.

Placeholder caption.